estate tax exemption 2022 proposal

Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US.

Tax Proposals Under The Build Back Better Act Version 2 0

Bureau of Labor Statistics Consumer Price Index.

. Upon adoption of this proposed amendment the federal gift and estate tax exemption for 2022. Severely limiting the effectiveness of GRATs. 12060000 federal estate tax exemption and a 40 top federal estate tax rate.

12 rows The federal estate tax exemption for 2022 is 1206 million. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Reduction of Estate Gift and GST Tax Exemptions as of January 1 2022 Under current law the exemption for estate gift and generation skipping transfer GST tax of. The Biden administration intends to revert the 117 million exemption to its pre-2010 limit of 35 million 7 million for couples accelerating the TCJA sunset date to early. If you have an estate of 10000000.

24 rows On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is. The good news is that. From Fisher Investments 40 years managing money and helping thousands of families.

Lifetime gift tax exemption is. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset. Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions.

The 117M per person gift and estate tax exemption will remain in place and will be increased. For 2022 the increased transfer tax exemptions are as follows. Reducing the estate and gift tax exemption to 6020000 effective January 1 2022.

Bernie Sanders has proposed that the exemption come down to 3500000 and not increase with inflation thereafter but this is not mentioned in the new plan. The estate tax exemption is. A provision of the proposed legislation that would become effective Jan.

Subjecting grantor trusts to estate tax. The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. No Changes to the Current Gift and Estate Exemption Provisions Until 2025.

The new exemption amount. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per. The revenue proposals are described in the Treasury Departments General Explanation of the Administrations Fiscal Year 2023 Revenue Proposals commonly referred to as the Treasury.

Previously this reduction was not scheduled to take place until January 1 2026. As of January 1 2022 that will be cut in half. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Some proposals would have sidelined a number of established estate planning strategies while other proposals could have increased the frequency of use and usefulness of.

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube

Now May Be The Time To Use Your Gift And Estate Tax Exemption Olsen Thielen Cpas Advisors

Consider Wealth Transfer Strategies In Advance Of Proposed Tax Law Changes Mariner Wealth Advisors

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

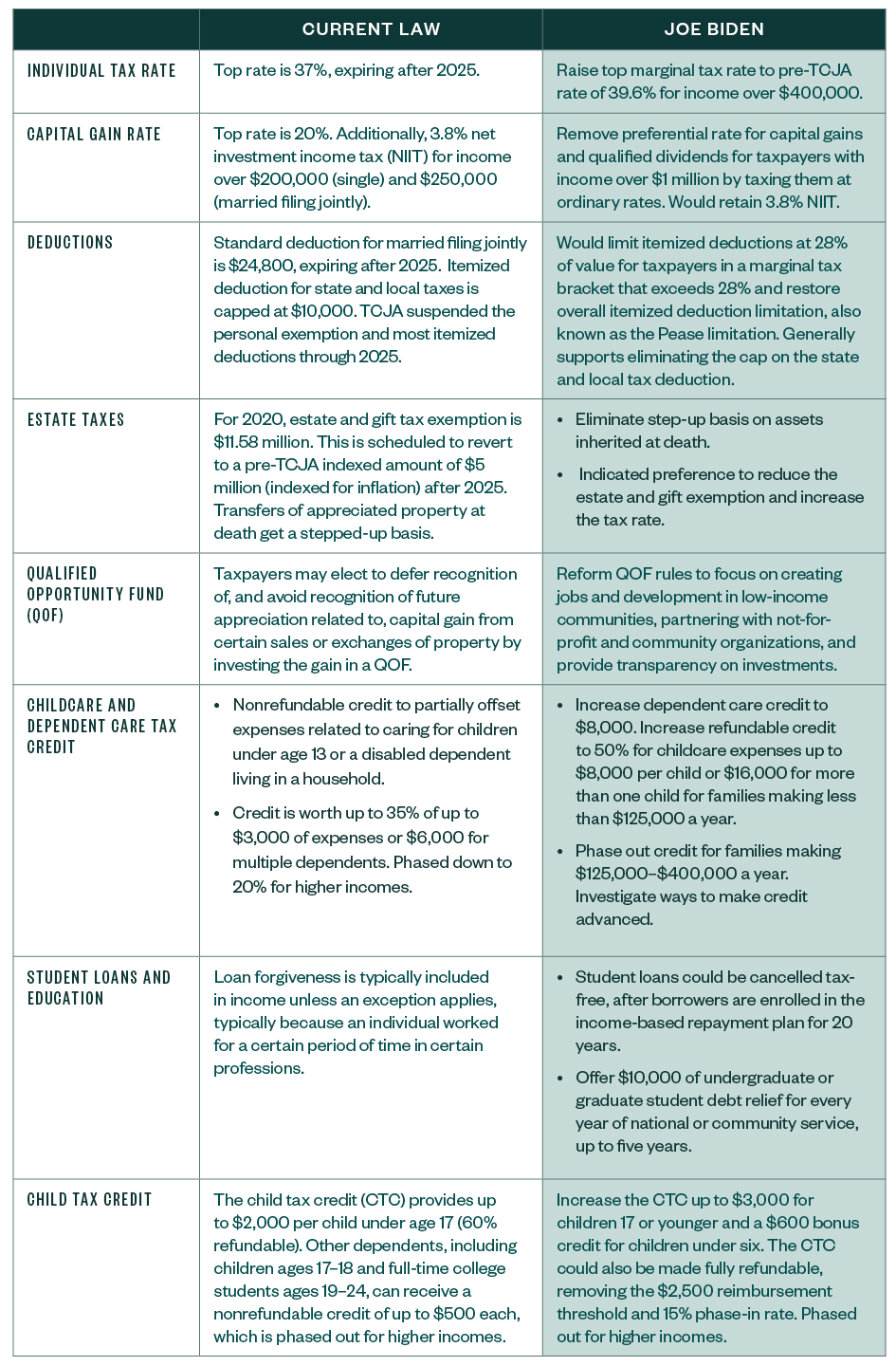

A Review Of Us President Elect Joe Biden S Tax Proposals

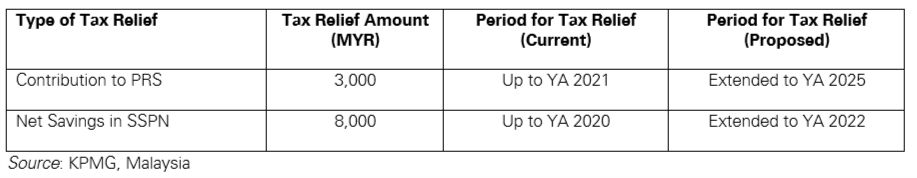

Budget 2022 Top Changes In Personal Tax

The New Death Tax In The Biden Tax Proposal Major Tax Change

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

How To Navigate The Dividend Tax Hike Brewin Dolphin

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Budget 2022 Direct Tax Proposals Tax India

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

What Happened To The Expected Year End Estate Tax Changes

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global